Some of you are going to love me for this post, and some of you are going to hate me.

Why? Because, I want to show you a way that could potentially cut your freelance transaction costs by hundreds, if not thousands of dollars. If you run a freelancing business, you typically need to work through a payment processing system, and I would bet that most freelancers use PayPal.

I’ve used PayPal for about three years, and I never really gave much thought to the 2.9 percent + $0.30 USD cost that they take from me every time I send an invoice to a client.

Then tax season came around and I started looking at all my expenses throughout the year. As a freelance blogger, PayPal drastically outweighed any other expense I encountered, even compared to large purchases like computers and office furniture.

That darn 2.9 percent was the problem. Let’s say I reeled in $50,000 for the year. My Paypal fees would come out to around $1,450, and that’s before they tag on the $0.30 fee per transaction. That’s a huge chunk of money to just throw down the toilet, and the costs aren’t any more bearable even if the income changes.

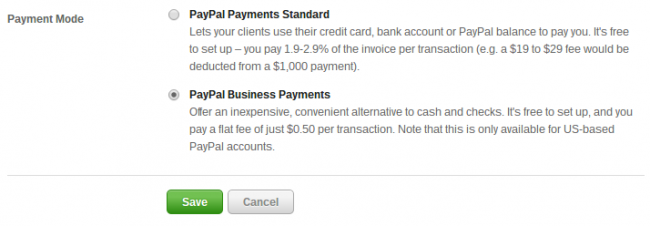

Even then I figured I had no choice but to foot the bill, until I accidentally stumbled upon a little forum discussion that talked about a system that only charged a flat fee of $0.50 per transaction.

The craziest thing about this is that the program is still run through PayPal, and I was already using one of the third-party software options that has exclusive rights to provide the program.

The program I’m talking about is called PayPal Business Payments, a simple system that started as a pilot program a few years back, and it only charges a flat fee of $0.50, as long as you don’t exceed $10,000 per transaction. This virtually eliminates the hefty fees for freelancers of all types, whether you invoice for writing, design or anything.

But, like I stated before, some of you are also going to hate me for this post, so let’s take a look at the PayPal Business Payments program a little closer to understand who this applies to.

It Only Works Through Specific Partners

Before you go scavenging through your PayPal account to activate the PayPal Business Payments program, take a breath for a second. You won’t find an activation option anywhere in your standard personal or business PayPal account. In fact, you can’t use the program unless you use one of the software partners that PayPal has decided to join up with.

That’s not to say it still isn’t a great deal. They only partner with invoicing and time management software companies, creating a seamless integration with options that will most definitely help you improve your workflow.

What are the partners you can choose from?

- Harvest

- FreshBooks – Here’s an in-depth overview of the program.

- That’s it. Yes the options are limited.

Like I stated before, I was already using one of these software when I discovered that I wasn’t even using the payment program. That software is Harvest, and I use it to track how long it takes me to work on client projects, with a direct integration to Trello. Now I use Harvest for all my invoicing. Before that I was simply using PayPal’s invoicing system.

This is good news for everyone who uses Harvest or FreshBooks, and it’s actually a chance for those who don’t to get a little more organized with highly useful software options. The best part is that Harvest and FreshBooks are quite affordable, making it so that you don’t completely nullify the savings you gain on PayPal Business Payments.

Harvest has a free version, but the client options are extremely limited. After that, it starts at only $12 per month, and even cheaper if you opt for a yearly payment. FreshBooks is a little pricier, starting at $19.95 per month.

Both options include wonderful time tracking features, along with nice invoicing and accounting reports. I’d say FreshBooks beats Harvest in the accounting aspect, but Harvest has a simpler interface and I don’t need all the bells and whistles for accounting that come with FreshBooks. Regardless, you can choose your favorite option and go with it.

The PayPal Business Payments Kicker

This is where some of you are going to want to throw something at me. The PayPal Business Payments program has some restrictions:

- Obviously you can only use it through FreshBooks or Harvest

- It only works if you and your client have US bank accounts linked to their PayPal accounts (This is pretty rough, but I’m thinking they might eventually expand to international transactions.)

- Your clients can’t make payments with a credit card

- There’s also a limit of $10,000 per transaction, but I don’t really mind that

The big restrictions here are the credit card requirements and the fact that you need to be in the US for the transactions to work. Many of my clients are in the US, but I also have quite a few that are scattered throughout the world. It’s even worse if you, the freelancer, lives in a country besides the US, because you can’t take advantage of this program at all.

I’ve noticed that most of my clients don’t pay with a credit card, but it’s certainly a hassle to try and explain this to someone who does use a credit card.

How to Set up PayPal Business Payments

This is what really irked me, because the setup process for Harvest is insanely simple, and all I had to do was click a button to save lots of money.

Harvest Setup

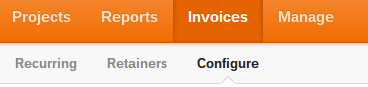

Create an account or login to your current Harvest account. Click Invoices > Configure, then navigate to the Online Payment tab.

Select PayPal as your payment choice, and click on Edit Settings. Punch in your PayPal email, select PayPal Business Payments and click Save. That’s it!

Freshbooks Setup

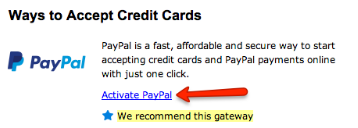

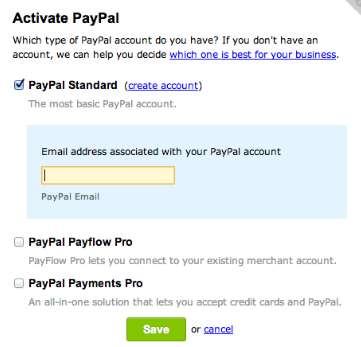

Login to FreshBooks. Navigate to Settings and click on Accept Credit Cards. Select the Activate PayPal option.

Check off Paypal Standard, punch in your PayPal email and click on Save.

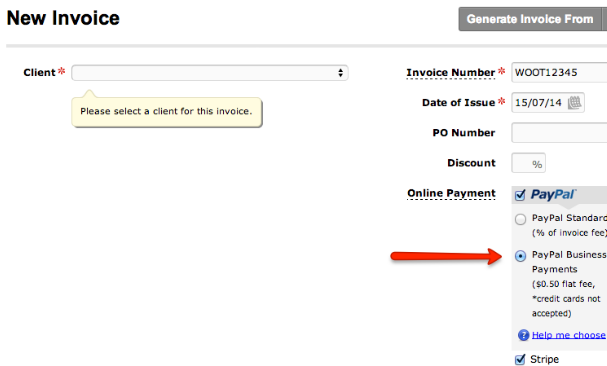

Then, all you have to do is create an invoice and specify that you want to use PayPal Business Payments. There is a radio checkbox that allows you to change this. That’s all there is to it.

Keep in mind that you must have a PayPal account already created for both of these to work.

That’s how I was able to save thousands of dollars by making one simple change with my invoicing process. Yes, I still have to foot the fee for some of my international clients, but it’s always nice seeing the small $0.50 fee for the ones that work in the US. Let me know if you have any questions about PayPal Business Payments below. Hopefully some of you can take advantage of this in the future.